Podcast

With Sunny J. Harris & Samuel K. Tennis

Want a Free 7-day Trial of SunnyBands? Click Here.

Our purpose is to bring famous traders, legends, authors and gurus to you so you can get to know them. First we will be introducing ourselves and each other so you can know what it is we do and why you might want to listen to this podcast. Sunny is a Professional Trader, Mathematician and EasyLanguage Programmer and Sam is a Professional Programmer and world-renowned EasyLanguage expert.

I've been trading the markets for 44 years, so I go back almost to where trading history began. I followed Larry Williams and Jake Bernstein in my early years, and got to know Larry as a friend. In fact, when he met my tiny Yorkshire Terrier Pewter he bought her sister from the same breeder. Larry lived just down the road from me. And when she was just 16 I met his daughter Michelle, who has gone on to be a famous actress. We will bring people like Larry & Jake to you in these podcasts.

Our guest wishlist includes people like: John Bollinger, Jake Bernstein, Alex Elder, Adrienne Toghraie, George Pruitt, Perry Kaufman, Harry Boxer and many more. Our list of potential interviews is over 80 people. (So far.) Ever wonder who the people are behind Trading books, Indicators and Systems? Ever wonder if they really make money trading? We will be asking them difficult questions about their lives, their ideas and what they think of the markets. And we will get to know them personally.

Tell all your trading buddies. If we get a big enough following we will continue doing it for a long, long time.

Trading in the financial markets involves a risk of loss. Podcast episodes and other content produced by MoneyMentor are for informational or educational purposes only and do not constitute trading or investment recommendations or advice.

Click Here to get a 7-Day FREE Trial of the Same Indicators Sunny uses in her own trading.

Podcasts of Others:

QUICK LIST: Thomas F. Basso . Jake Bernstein . John Bollinger . Carolyn Boroden . Harry Boxer . David Capablanca . Tushar Chande . Robert Colby . Arch Crawford . Tom DeMark . Stan Ehrlich . Alexander Elder . Peter Eliades . William Eng . Michael Filighera . Howard Getson . Norman Hallett . Price Headley . Ted Hearne . Marcus Heitkoetter . Gene Inger . Cynthia Kase . Perry Kaufman . Jim Kenney . David Kosmider . Joe Krutsinger . Micah Lamar . Michael Lydick . Brad Matheny . Sherman & Tom McClellan . Anka Metcalf . Robert Miner . Greg Morris . Jon Najarian . Louis Navellier . Glenn Neely . Tomas Nesnidal . Steve Nison . Wally Olopade . Robert Pardo . Dan Passarelli . Larry Pesavento . Steven Primo . Fausto Pugliese . Linda Raschke . Hima Reddy . Jody Samuels . Tim Slater . Adrienne Toghraie . Marina Villatoro . Henry Weingarten . Larry Williams . Norm Winski

EPISODE #001: Sunny & Sam Introduce the Concept & Each Other Sam: sktennis@vista-research.com Sunny: sunny@moneymentor.com -

Sunny J. Harris, BA, MS, PhD Mathematics, founder and president of Sunny Harris Enterprises, is a professional S&P, US-Bonds, Crypto and Stock Market Equities trader. Since retiring from ISSCO (her immensely successful computer graphics software firm) in 1981 she has traded stocks, bonds, mutual funds, metals, real estate, investment gems, options, futures, and FOREX. Sunny published Traders’ Catalog & Resource Guide for eight years, sponsors The Money Mentor on the Internet, and created a CD-ROM for traders, in addition to being rated #1 CTA in the under $10 million category by Stark Research, achieving 365% profit in 1993 and 178% in 1994. Ms. Harris’ first book, Trading 101—How to Trade Like a Pro was released in July 1996 by John Wiley and Sons and has proved to be a top seller. Her second book, Trading 102—Getting Down to Business was released in October 1998. She subsequently wrote Electronic Day Trading 101 and Getting Started in Trading in 2000 and 2001 respectively. In 2011 she released TradeStation Made Easy! . All through John Wiley & Sons. And now with Sam Tennis she published The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming in August 2023.

Samuel K. (Sam) Tennis, the author of Ask Mr. EasyLanguage (TradersPress) and co-author of TradeStation's EasyLanguage Object-Oriented Programming Made Easy!, is the world's leading authority on TradeStation and EasyLanguage programming. He acquired this distinction during ten years as senior programmer at Omega Research, Inc. (later rebranded as TradeStation), where he played a vital role in the creation of System Writer Plus, EasyLanguage and TradeStation. As Omega expanded and the need for technical support grew, Sam moved out of hands-on programming and into customer support, where he trained Omega's product support personnel to provide fast, reliable technical support. Then, while coordinating the efforts of the custom-programming department, Sam spearheaded the effort to provide nationwide on-site field training for Omega clients. Today as head of Vista-Research, Sam uses his experience at TradeStation and knowledge of EasyLanguage to provide traders of all flavors the finest computer technical support available. This support is not limited to TradeStation products, but extends to MultiCharts and TradingView and such other areas as operating systems (DOS and Windows), hardware, software, installation, back office applications, and system development. Sam also provides expert programming using EasyLanguage and OOEL and has a bevy of applications he sells to the public at a modest cost. Sam may be reached at any time by email at SKTennis@Vista-Research.com and by text at (850) 582-7342. Contact by phone should be scheduled in advance.

Michael was that little kid who always took things apart and wanted to know how they worked, leading to a BS in Mechanical Engineering and a nearly 20-year career as a Machine Designer in New York. He now resides in North Carolina with his wife and three kids, developing data-mining software for day traders and retail investors. Loving to live on the edge of new technologies, Michael's obsessions include remote control "first person view" drones, 3D printing, hydroponics, Arduino programming, and DIY solar and wind power for his office and greenhouse. Michael co-founded Back To The Future Trading, where he developed what would become the world's first comprehensive predictive market timing tool. He is also the founder and CEO of Higher Purpose Inc., where he combines imagination and engineering to solve challenges in various fields, including software development, training, and multimedia presentations.

EPISODE #54: Fausto Pugliese - Founder of Cyber Trading University

Fausto Pugliese is founder and president of Cyber Trading University. Pugliese began his career on Wall Street as a stockbroker and was one of the first independent traders to take advantage of the Direct Access Trading technology boom that started in 1987. He has appeared on Fox News, CNBC, and other financial shows Fausto Pugliese was one of the original Day Traders of the early 1990s and one of the first independent traders to take advantage of the Direct Access Trading technology boom in 1987. He acquired a wealth of knowledge from years of hands-on experience, beginning in the trenches, working side by side with some of the most practiced and successful traders in the industry. After spending considerable time mastering the art and discipline of day trading, Fausto chose to start his own company to share some of his highly-sought-after wisdom. Fausto is the 12-time champion at the World Traders Challenge, and is the author of How To Beat Market Makers At Their Own Game. He recently started appearing on Nasdaq TradeTalks!

EPISODE #53: Tom Busby - Diversified Trading Institute

Diversified Trading Institute (“DTI”), was founded in 1996 by Tom Busby, a professional securities trader and broker since the late 1970’s. Tom started with Merrill Lynch in 1980 and in 1984 became Vice President of Smith Barney. Quoted and published in Active Trader magazine, Tom actively trades and invests in stocks and options. Guest appearances include CNN, First Business News, MoneyShow.com and Steve Crowley’s American Scene Radio. Recognized as one of the first educators to trade live in front of an audience, Tom has authored "Winning the Day Trading Game", "Trade to Win"0, and "The Markets Never Sleep". Tom is a Former Air Force Officer, an Active Trader Since 1970s, Author of 3 books and Has worked w > 100,000 TradersEPISODE #52: David Capablanca - Master Short Seller of Small Cap Stocks - David Capablanca's journey from architecture to master trader is as inspiring as it is unconventional. Initially immersed in the world of architecture, David studied at the University of Florida and later earned his master's degree from UCLA. His path, however, took a dramatic turn when he was diagnosed with a brain tumor during his first quarter at UCLA, leading to emergency surgery and a year-long recovery. Despite these challenges, David continued his studies while managing an extensive financial burden from student loans. Facing mounting debts and limited income as an architect, David was driven to explore new career avenues. The COVID-19 pandemic provided a volatile market environment that David capitalized on, leveraging his meticulous approach honed through years of architectural design to excel in short selling. With just $29,000 to his name, David turned this challenging period into a significant opportunity, mastering the art of short selling amidst market chaos. David's success in trading grew, leading to substantial gains during market events like the GameStop and AMC phenomenon. His background in architecture, which had taught him to recognize patterns and structures, proved invaluable in developing a systematic approach to trading. Today, David Capablanca is not only a seven-figure master trader with a verified 90% win rate but also a dedicated educator.

EPISODE #51: Jeffrey Hirsch - Jeffrey A. Hirsch is the President of the Hirsch Organization and Editor in Chief of the Stock Trader's Almanac. He worked with founder Yale Hirsch for fifteen years, taking over from his father, Yale Hirsch, in 2001. He appears frequently on CNBC, CNN, Bloomberg, Fox Business, and many other national and international media outlets to discuss market cycles, seasonality, trading patterns, predictions, and historical trends. Hirsch also edits the firm's digital toolkit, Almanac Investor, a subscription-based product including investor alerts, market data, and research tools.

EPISODE #50: Marina Villatoro - As a Soviet Union refugee during the Cold War Marina Kuperman Villatoro arrived in New York City. 20 years later she took off on a backpacking journey with no end in mind. While camping in the Tikal Mayan Ruins of Guatemala, she met her future husband, the first Guatemalan she ever met, who was camping in the next tent over. They've been married for over 22 years, and raising their 2 trilingual sons. Marina has been an entrepreneur for over 25 years. Starting out as a top fitness instructor in NYC gyms with a wanderlust, she became a travel writer (and still hosts a popular travel site today - TravelExperta.com). Plus, she had a full on obsession for the financial markets and has been day trading for over 13 years plus a top Day Trading Educator with courses. She is also known as Marina 'The Trader Chick' and her other business is TheTraderchick.com.

EPISODE #049: Tomas Nesnidal - Mr. Breakout - author of "The Breakout Trading Revolution" Tomas is a trader with more than 11 years of experience. He shares his knowledge on his blog, SystemsOnTheRoad.com Tomas came to trading about eleven years ago after an entirely different career. He used to work as film director, in the Czech Republic but it was a very difficult profession from a financial perspective. So, he left film directing completely and became full time trader. Like many traders, Tomas started as a discretionary trader before becoming interested in systematic approaches. Even for a skilled strategy developer, however, building trading strategies proved to be a difficult process that takes time away from trading. He found out information about Genetic Algorithms and Genetic Programming which got his attention immediately. And he was off to the races. Tom’s favorite thing to do is travel. He spends a lot of time in East Asia, Spain and other countries. He says: “I live for trading and traveling.” And he travels while trading.

EPISODE #048: Robert Miner - Dynamic Trader, Gann-Elliott & Fibonacci Price and Time Expert - Robert began his career in the mid-80’s with his first company, Gann-Elliott Educators, where he produced analysis reports for the major financial markets and presented live workshops in the U.S. and overseas. In the mid-90’s he founded Dynamic Traders Group to provide market analysis and trade strategy reports, practical trade education and developed his Dynamic Trader Software. Mr. Miner wrote the first self-study trading course in 1989 where he expanded on and integrated the work of W.D. Gann, R.N. Elliott and his own unique approach to Fibonacci time and price target strategies -- into his own comprehensive and original approach to multiple time frame time, price, pattern and momentum trade strategies. Robert’s first book, "Dynamic Trading", was named the “Trading Book of the Year” by the SuperTraders Almanac and he was named the 1997 “Guru of the Year”. His book, "High Probability Trading Strategies", has been one of the consistently top selling trading books since its release in 2008. It has become a must-read classic trading book of practical trade strategies. Robert is recognized as one of the few trading educators with an actual multi-year record of trading success. In 1993, he won first place in an annual real-time, real-money trading contest for futures. In more recent years, he has demonstrated the effectiveness of his practical trade strategies with audited returns and he has won awards five consecutive years for real time trading contests with double and triple digit annual returns. Traders from over 30 countries subscribe to his DynamicTrader Report and have studied his Dynamic Trading Master Course, a complete course of practical trading instruction for all actively traded markets. And Carolyn Boroden, the Fibonacci Queen, attributes her career to Robert. "The Definitive Guide to the Election Cycle and Stock Market Trends" is Robert’s most recent book and includes real world, practical application for stock market traders. To learn more about Robert, go to www.DynamicTraders.com.

EPISODE #047: Micah Lamar - expert Options Trader and CEO of wallstreet. Micah Lamar is a multi-talented individual with a diverse range of interests and pursuits. Lamar is a founder and CEO of WallStreet.io, a community of traders and engineers. He is an expert in options trading and has developed the PayDay Cycle Strategy. He has also authored the #1 rated Apple Investment Strategy Guide and has created the AAPL Pay Day Package. Micah Lamar is also a glass artist based out of Santa Barbara, California and has exhibited his work in various collections, including the Bead Museum in Washington, D.C. and The Crown Princess Victoria of Sweden.

EPISODE #046: Jon Najarian Jon Najarian is a renowned American options trader, entrepreneur, money manager, media analyst, and a well-known eloquent pundit. Born on September 29, 1957, he is 67 years old as of 2024. Jon is the son of Dr. John Najarian, a famous Minnesota doctor and surgeon. Jon’s father studied medicine at the University of California, Berkeley, where he was also an offensive tackle for the college’s football team and played in the 1949 Rose Bowl. Jon later co-founded optionMONSTER, an options news and education firm, with his brother Pete Najarian. He is also the co-founder of tradeMONSTER, an online brokerage that sends trading information through the web without requiring clients to download trading software. As a media personality, Jon Najarian has been a business anchor for FOX Chicago & First Business, a show that airs in 160 markets across the country. He has also teamed up with his brother Pete and professional trader Guy Adami to start Drakon Capital, a sister company of optionMONSTER and tradeMONSTER.

EPISODE #045: John Bollinger John Bollinger, CFA, CMT, is the founder and president of Bollinger Capital Management, and is internationally known as the developer of Bollinger Bands. His book, “Bollinger on Bollinger Bands” has been translated into twelve languages and his website www.BollingerBands.com is the hub for everything related to Bollinger Bands.www.BollingerBands.us provides charts, signals, screening and tools to analyze the market and make trading decisions based on Bollinger Bands. Mr. Bollinger is the recipient of the TSAA-SF Lifetime Award for Outstanding Achievement in Technical Analysis, the MTA (now the CMT) Annual Award for Outstanding Contribution to the Field of Technical Analysis, and the IFTA Lifetime Achievement Award.

EPISODE #044: Tom DeMark Tom DeMark is the founder and CEO of DeMARK Analytics, LLC and the creator of the DeMARK Indicators® library. Tom’s investment career began nearly 50 years ago at multibillion-dollar pension fund, National Investment Services, where he was ultimately tasked with researching strategies to improve the company’s investment timing. Disenchanted with the concepts available at that time, Tom began developing the proprietary moderls that would become the hallmark of his career. Following his time at NIS, Tom consulted with some of the largest trading institutions and fund managers in the world, including Goldman Sachs, Dean Witter, Citibank, IBM, MMM, Mark Steinhardt, George Soros, Paul Tudor Jones, Van Hoisington, Charlie DiFrancesca and Leon Cooperman. Tom currently serves as special advisor to investment titan, Steven A. Cohen of Point72, a role he has held for over 27 years. In 2020, the CMT Association recognized Tom DeMark with its Annual Award, an honor that recognizes a lifetime of achievement in the industry. Tom has spent much of his career developing, refining, trading and teaching his proprietary techniques to people around the world and remains actively involved in the financial markets.

EPISODE #043: Tushar Chande - For more than fifteen years, Tushar Chande traded the futures markets for high-net-worth individuals and institutional clients as a CTA and hedge-fund owner. He has cemented his reputation as one of the most creative contributors to technical analysis as the author of "The New Technical Trader" (with Stanley Kroll) and of "Beyond Technical Analysis", two of the most important books on technical indicators and trading systems in the past 30 years. Hundreds of millions of dollars have been traded using his ideas and concepts. He was the first to create adaptive exponential moving averages (VIDYA) and the adaptive RSI (Dynamic Momentum Index). This idea of adapting indicators has subsequently spread across the rest of the indicator universe. He is the creator of wildly popular indicators such as stochRSI, Aroon, CMO, Forecast Oscillator, Qstick, and many more. His indicators are included in virtually all major trading platforms and TA packages. He has earned a Ph.D. in Engineering, an MBA in Finance, and more than ten patents from the USPTO.

EPISODE #042: Steve Nison -candlecharts.com - Steve Nison, acknowledged as the authority on candlesticks, holds the distinction of introducing Japanese Candlestick Charting to the Western world. Indeed, the foundation of all candlestick information in America and Europe is based on Mr. Nison’s work. Regarded as one of the most foremost technical analysts in the world, Mr. Nison is not only a master of these previously secret candlestick techniques, but is also an expert on Western technical analysis with over 30 years real world experience. Mr. Nison’s books have been translated into 21 languages. And his work has been highlighted in throughout the financial media around the world. He has presented his strategies to self-directed traders and investors and top financial firms around the world. He has also lectured at numerous universities and, by request, at the World Bank and the Federal Reserve.

EPISODE #041: Gene Inger - ingerletter.com - Gene began investing at 13 years old (and he will tell us that story) which led to his early career at a major Wall Street firm. He managed portfolios and anchored at KWHY-TV Los Angeles, the nation's first financial television program, calling major market moves. Mr. Inger began the long-running Inger Letter and developed his own station in New York/New Jersey that featured Wall Street and market programming. His West & East Coast Stock Market Today shows became FNN affiliates and merged into the CNBC Network. (Mr. Inger was one of the original CNBC Market Mavens.) Now retired from portfolio management, Mr. Inger publishes his popular Daily Briefing commentary nightly. He updates its companion MarketCast several times daily, with a focus on intraday patterns for S&P stock index futures, as well as other major indexes, such as oil, the dollar, silver and gold, plus Treasuries and commodities.

EPISODE #040: Hima Reddy - himareddy.com - Master Trader & Gann Technician/Theorist. Hima Reddy is a Wall Street veteran analyst, Financial Times published author, active trader, and prolific educator with a passion for technical market analysis, specifically Gann Analysis. Her mission is to empower individuals to participate in the financial markets to create primary or secondary income streams to attain freedom. Hima is the last trading coach you'll ever need, and she leads a tribe of traders who are like-minded action-takers and students of the markets. Hima and her traders believe that it's possible to master the markets by focusing on just three things: price data, momentum analysis, and market timing. They know that trading results can be optimized quickly with the right practice and guidance, and that having a trading mentor with 20+ years of trading and analysis experience is far more powerful than having someone who simply says "buy this, sell that". Hima started learning futures trading from her dad at the age of 16, and went on to work at multiple Wall Street firms, from research houses to investment banks. Wall Street even called her back to consult during the summer and fall of 2022! She not only knows how to trade and analyze the markets using her proprietary methods, but she also knows how to teach them to others. Hima is especially known for her work in Gann analysis, and she's one of the world's leading experts, having published two academic books on that specialized topic. To date, Hima has taught and mentored thousands of traders seeking a consistent trading income to give themselves and their families the life they deserve. Her philosophy is that trading is simple but not easy right out of the gate. But with strategic effort, anyone can achieve success in the markets. Hima's experience and knowledge, starting at a very young age, can be of insanely high value to you if translated properly. Outside of her profession, Hima loves to dance and enjoys exploring her Indian culture and all that it has to offer.

EPISODE #039: Brad Matheny - I had a delightful and thought-packed hour with Brad Matheny and hope you will enjoy it too. Brad Matheny is the author of "Trading Applications of Japanese Candlestick Charting." Brad combines the expertise of a registered commodity broker and a systems analyst on candlestick charting methods. In this book he goes a step beyond existing literature to discuss practical applications of the technique and recommended strategies. He integrates candlestick charts with Western technical indicators and trading methods such as stochastics, Elliott Wave, moving averages and oscillators. The book features significant treatment of computer analysis of candlesticks.

EPISODE #038: Dr. Alexander Elder - We are honored to have had Dr. Elder on our show to talk about his many years as a master trader and educator. Alexander Elder, M.D., is a professional trader and a teacher of traders. His books, including The New Trading for a Living are international bestsellers among private and institutional traders, translated into 17 languages. Dr Elder was trained as a psychiatrist and served on the faculty of Columbia University. Now he is a full-time trader who shares his hard-earned lessons with his students. He is a sought-after speaker at conferences in the US and abroad.

EPISODE #037: William Eng Today we are honored to have William Eng join us. Bill graduated from Northwestern University in 1971 with a psychology major and a sociology minor. He then enrolled at the University of Chicago MBA program in 1972. His first job was a a trader trainee at H.S. Kipnis & Company, a Third Market trading company. He was there from July 1971 - May 1973. Bill's second job was as an Investment Advisor at the First National Bank of Chicago (now J.P. Morgan Chase) from May 1973 - September 1974. He worked in the division created by former chairman, A. Robert Abboud. The Money Market division floated about 60% of the money center bank's liabilities daily. After two employers Bill decided to become an independent trader at the job lot exchange, Chicago Open Board of Trade (which merged into the Chicago Board of Trade) from October 1974 - June 1976. After a self-training period, I bought a full membership at the Midwest Stock Exchange (now the Chicago Stock Exchange) and traded stock options for six years when the premier stock options exchange, Chicago Board Options Exchange absorbed the Midwest Stock Options in 1982. Eng is the author of: "The Technical Analysis of Stocks, Options and Futures", "Trading Rules: Strategies for Success", and "Trading Rules II". He has also published: "The Day Trader's Manual", and "Options: Trading Strategies that Work".

EPISODE #036: Louis Navellier - Louie Navellier is Chairman and Founder of Navellier & Associates in Reno, Nevada, which manages approximately $1.0 billion in assets. Navellier also writes five investment newsletters focused on growth investing: Growth Investor, Breakthrough Stocks, Accelerated Profits, Power Options and Platinum Growth Club, and can frequently be seen giving his market outlook and analysis on Bloomberg, Fox News, and CNBC.

EPISODE #035: Cynthia Kase - Cynthia A. Kase is an expert on crude oil, refined products, fuel oil, natural gas and related commodity trading and hedging, a technical forecaster, and energy price and price risk analyst. Ms. Kase has a parallel expertise and is recognized as a world leader in technical analysis, technical market forecasting, and trading and hedging algorithm and financial market software development. She is also president and founder of Kase and Company, Inc., which she established in 1992, a U.S. based energy risk management and financial software firm. Kase and Company, Inc. provides energy hedgers with clear, comprehensive, energy risk valuation and management policies, procedures, and strategies, as well as ongoing hedge strategy support. Additionally, the firm provides trading, decision support, and risk management software solutions and is registered as a Commodity Trading Advisor with the CFTC.

EPISODE #034: Howard Getson - Howard Getson is CEO of Capitalogix. Capitalogix develops "Hedge Fund-In-A-Box" technology with thousands of artificial intelligence Trading Systems evaluating global markets on a massive scale in the Cloud. We use thousands of algorithmic trading systems, an automated testing platform, and a database of trillions of performance records to identify the trading candidates with an edge in different markets & trading conditions. Bottom-line, we do what we do in order to find and trade what is working, while it is working, in real-time. Instead of high frequency trading, you can think of what we do as high frequency asset allocation and re-balancing. It’s all about calculating probabilities faster.

EPISODE #033: Jake Bernstein - Jake Bernstein is an internationally recognized futures analyst, trader and author. He has written more than 41 books, numerous research studies and newsletters on futures trading, stock trading, trader psychology & economic forecasting. Mr. Bernstein is publisher of Jake Bernstein's Weekly Futures Trading Letter which has been in continuous weekly publication since 1972...Now presented in digital media format as The Jake Bernstein Online Weekly Capital Markets Report and Analysis. Beginning trading futures and stocks in 1968, Jake has appeared frequently on radio and television throughout the United States and Canada. He has been a guest on numerous business radio and television shows including Wall Street Week, CNBC, JagFN.TV and WebTV.com. Mr. Bernstein also lectures extensively in the United States, Canada, Europe and Asia. His forecasts and opinions are quoted frequently in the financial press and on numerous websites. Mr Bernstein is a consultant to investors, traders, industry, financial institutions, short-term traders, brokerage firms and commercial firms. His market advisory services are subscribed to by floor traders, professional traders, money managers, both new and experienced traders and hedgers, the world over.

EPISODE #032: Arch Crawford - Arch Crawford is a financial astrologer who was a 1st Lt in Vietnam 1969 on loan to CIA in their Phoenix program. Issued CIB while there (Combat Infantryman Badge) Mustered out as Captain in Inactive Reserves. Arch was a member of Pi Kappa Alpha social fraternity at the Univ. of North Carolina. Arch was twice President of "Women's Lib, Men's Lib" at the Universalist/Unitarian Church in NYC. Arch was on CNBC as #1 Stock Market Timer of 2008. His market newsletter was listed by Hulbert Financial Digest as #1 Stock Market Timer for the 5-Year period ending June 1997.

EPISODE #031: Henry Weingarten - Henry Weingarten, was the founder of the New York School of Astrology and the New York Astrology Center and has been a professional astrologer for over forty years. His books are Investing by the Stars: Using Astrology in the Financial Markets and Study of Astrology. He is the managing director of the Astrologers Fund and predictor of such market benchmarks as the 1990 Tokyo stock market crash and the start of the Persian Gulf War. In 2001, Mr. Weingarten's successful forecasts include the drop of the Tokyo market below 12,222, several "surprise" interest rate cuts, and two dramatic calls to stay the course: the first in March and the second in mid September. The results? April was the largest US stock market rise in 10 years!

EPISODE #030: Robert Pardo - Robert Pardo, originator of Walk Forward Testing. Bob Pardo has decades of experience in trading, the creation of robust trading strategies and the analysis of markets. He brings this rich experience to the creation and application of the products and services of Pardo & Company. Bob's trading program XT99 Diversified, offered by Pardo Capital Limited, was cited over three dozen times for top performance. He was a consultant to top trading firms such as Goldman Sachs and Daiwa Securities America through his firm Pardo Group Limited. He was an algorithmic application and technical analysis pioneer with his ground breaking software at the Pardo Corporation. He is the creator of Walk-Forward Analysis, the gold-standard in strategy validation. Bob is the author of the definitive guide to trading strategy development The Evaluation and Optimization of Trading Strategies.

EPISODE #029: Sherman & Tom McClellan - Sherman McClellan earned a degree in business administration and economics from Claremont Men’s College (now Claremont McKenna College), but found out after graduation that the standard types of fundamental analysis taught in school did not provide enough of the answers concerning why and when stock market prices moved. Dissatisfaction with a number of methods for technical analysis led him to develop new techniques for assessing market conditions. Sherman and his mathematician wife Marian developed the McClellan Oscillator and Summation Index in 1969. It took their combined talents to do the work then, in a day when computers were unavailable, and when charts had to be drawn by hand. Tom McClellan is the editor of The McClellan Market Report newsletter, and its companion Daily Edition. Tom McClellan, son of Sherman and Marian McClellan, is a graduate of the U.S. Military Academy at West Point. Tom served as an Army helicopter pilot for 11 years before taking up a new career as a stock market analyst.

EPISODE #028: Stan Ehrlich - inventor of the Ehrlich Cycle Finder. Stan Ehrlich started in the Futures industry in 1971 as a runner on the Chicago Futures Exchanges. A year later he was a Futures Broker with Conti Commodity Services at their flagship office in the CBOT. In 1978 Stan Ehrlich invented the Ehrlich Cycle Finder™, a universal technical analysis tool, and now the oldest physical technical analysis device in the Investment Industry worldwide.

EPISODE #027: Steven Primo - Steven Primo has been actively involved in trading the markets for over 40 years. His trading tenure began in 1977 when he was hired to work as a Floor Reporter, or “runner”, on the floor of the Pacific Stock Exchange. Primo reached the pinnacle of his floor-trading career when he became a Stock Exchange Specialist for Donaldson, Lufkin, and Jennrette. As a Specialist he was responsible for making markets in over 50 stocks, a position Primo held for 9 years. Primo left the Stock Exchange floor in 1994 to focus on managing money and to teach his own unique approach to trading the markets. Scores of students, from beginner to advanced levels, have gone on to become successful traders after being introduced to Primo’s proprietary methods of trading. Steve has also been featured in “Stocks and Commodities” magazine and is a frequent contributor to many sites such as Tradingmarkets, FXstreet, Forex Pros and Traders Expo. His strategies are now traded across the globe in over 100 countries on 6 continents.

EPISODE #026: Carolyn Boroden is a technical analyst with over 25 years of experience, specializing in Fibonacci analysis. She focuses on the ratios derived from the Fibonacci number series, and she applies these ratios to both the price and time axis of the market, to identify trade setups. She works to identify key support or resistance that you can trade against. Her unique form of price and time analysis is quickly proving to be one of the most promising trading techniques using Fibonacci available today. Ms. Boroden's first book, Fibonacci Trading: How to Master the Time and Price Advantage, was published by McGraw-Hill in early 2008. She is running a trading room at Elliottwavetrader.net and teaches her methodology at IM.academy.

EPISODE #025: Markus Heitkoetter Markus is a self-made multi-millionaire who was born in Germany. He came to the US in 2002 with $30,000 in his pocket and a dream to become a successful trader. Over the past 20 years, he traded and invested his way to success in the stock and real estate market, making millions of dollars in the process. Markus has written three best-selling books about trading and investing that have been translated into multiple languages. His Youtube channel with over 4 million views is dedicated to his favorite topic - which is trading stocks and options. In 2005 Markus founded Rockwell Trading, originally as a way to share what he was doing with friends and family. Now 16 years later, Markus has connected with over 300,000 traders in more than a dozen countries across the globe. He lives in Austin, TX where he enjoys spending time on the lake watching his kids racing their sailboats.

EPISODE #024: Dan Passarelli Dan is an author, trader and former member of the Chicago Board Options Exchange (CBOE) and CME Group. Dan has written two books on options trading — “Trading Option Greeks” and “The Market Taker’s Edge.” He is also the founder and CEO of Market Taker Mentoring, Inc., a leading options education firm that provides online options education, options newsletters and personalized, one-on-one coaching for option traders. Dan began his trading career on the floor of the CBOE as an equity options market maker. He also traded agricultural options and futures on the floor of the Chicago Board of Trade (now part of CME Group). In 2005 Dan joined CBOE’s Options Institute and began teaching both basic and advanced trading concepts to retail traders, brokers, institutional traders, financial planners and advisors, money managers, and market makers. In addition to his work with the CBOE, he has taught options strategies at the Options Industry Council (OIC), the International Securities Exchange (ISE), CME Group, the Philadelphia Stock Exchange and many leading options-based brokerage firms. Dan also contributes to financial media such as TheStreet.com, FOX Business News, Bloomberg Television, National Public Radio (NPR), and the CBOE blog. And he has a weekly featured video on CBOETV.

EPISODE #023: Ted Hearne Drummond Geometry Guru. Ted Hearne is a Chicago-based forex and bond trader who has written extensively about trading and has co-authored a "technical analysis explained" course called "Drummond Geometry." The method establishes support and resistance areas in multiple time periods and uses these to determine high probability trading areas. DrummondGeometry.com is a service of Ted Hearne Associates, Inc., a trading, software, and consulting firm with expertise in financial markets, communications, and technology. They develop advanced trading software and educational programs for analysis and trading in the global debt, equity, and futures markets.

EPISODE #022: Norm Winski - Norm Winski, publisher/editor of Astro-Trend is a former Chicago floor trader with over 40 years of market experience. The Astro-Trend letter utilizes advanced technical and cyclical analysis to forecast about 30 futures related markets. In 1991, Technical Analysis of Stocks & Commodites Magazine awarded Norm Winski the title of “Certified Technical Genius”. Download the Notes for his Presentation.

EPISODE #021: Larry Pesavento is the founder and owner of Trading Tutor, a technical analysis education service that emphasizes recurring pattern recognition techniques. Larry is a 45-year veteran of the finance industry who began his trading career on a full-time basis in 1969. Author of Trade What You See, Fibonacci Ratios, Astro Cycles, Opening Price, Harmonic Vibrations and many more.

EPISODE #020: Greg Morris - Gregory L. Morris currently works as a consultant in the field of technical analysis and money management but is trying hard to retire. He is a Senior Advisor to McElhenny Sheffield Capital Management, an RIA in Dallas, Texas and recently was the Chairman of Stadion’s Board of Trustees. Greg has been a technical market analyst for 50 years and is enjoying semi-retired life. Recently, Greg updated his “The Complete Guide to Market Breadth Indicators” book (available on Amazon), writing a blog for StockCharts.com called Dancing with the Trend, and playing lots of golf. Greg has written three books with McGraw-Hill; “The Complete Guide to Market Breadth Indicators,” a book introducing market breadth analysis for investors, a third edition (original edition in 1992) to his best-selling and vastly expanded “Candlestick Charting Explained” was released in March 2006, and “Candlestick Charting Explained Workbook,” which was published in December 2011. Greg completed his fourth book in 2014, “Investing with the Trend – A Rules-based Approach to Money Management” published by John Wiley under the Bloomberg Press label. This is a book about the flaws of modern finance, research on risk and trend analysis, and how to build a rules-based trend-following model. In 2011, Greg produced Japanese Candlestick Pattern Recognition software for MetaStock. This is an add-on package that not only offers automatic identification of real patterns but provides a sophisticated trend analysis measure and automatic support and resistance identification.

EPISODE #019: Linda Bradford Raschke delights us with her stories! lindabradfordraschke.net Contact Linda Linda Bradford Raschke is an American financier, operating mostly as a commodities and futures trader. She started as a member of the Pacific Coast Stock Exchange, traded on the Philadelphia Exchange, and then became a registered CTA and founded LBR Asset Management. She is a world-renowned trader with a top-notch track record spanning almost four decades. She has been the principle trader for several hedge funds and started her own hedge fund in 2002 for which she was the CPO (Commodity Pool Operator). Linda’s hedge fund was ranked 17th out of 4500 for best 5 year performance by BarclaysHedge and her early successes were recognized by Jack Schwager in his renowned Market Wizards series. Linda retired as a CPO and CTA in 2015. However, she continues to trade daily for her own account….the same managed money program she has traded since 1992.

EPISODE #018: Anka Metcalf - TradeOutLoud.com - Anka Metcalf is a professional trader with 20+ years of trading experience in STOCKS and FUTURES who spent over a decade working in investment banking prior to becoming a full time trader. She is the Founder and CEO of TradeOutLoud.com, an international trading education company designed to help any level trader fast track their trading and achieve their trading goals. She is an expert day trader, swing trader and active investor with a precise approach to delivering results in any market environment.

EPISODE #017: Robert Colby - https://www.colbyassetmanagement.com/ Robert W. Colby, CMT, Chairman and Chief Investment Strategist, brings his 45+ years of Wall Street research and trading experience to lead our firm. He has witnessed firsthand the monumental failure of the highly-advertised "buy and hold" strategies and "asset allocation rebalancing" strategies typically sold to the public. Robert believes investors deserve a better alternative, so he started this firm to use his time-tested research to help investors recover from the failures of the establishment investment firms and prosper going forward--no matter what the stock market may do. Robert is the author of The Encyclopedia of Technical Market Indicators, Second Edition, McGraw-Hill, 2003, which has become the standard reference for indicator and trading systems design. His work has been published in Forbes, Institutional Investor, The Wall Street Journal, Investors Business Daily, Technical Analysis of Stocks & Commodities, SFO (Stocks, Futures and Options Magazine), Active Trader, The Technical Analyst, MarketWatch, TradingMarkets, Physician's Money Digest, PC Magazine (technical analysis software reviews), Futures Magazine, and Trader Planet, among others. Over the years, he has written papers on investment strategies, research methodologies, fundamental indicators, and chart pattern interpretation.

EPISODE #016: Larry Williams - www.ireallytrade.com - Larry Williams has been trading futures, commodities, and stocks for almost 60 years. Through good years and bad Larry has survived recording and teaching his market wisdom. Larry is a best selling author featured in our Books section. You can find most of the books Larry has written there. Larry Williams has taught thousands to trade the markets, and has been the only futures trader in the world to repeatedly trade $1 million of his own money live at seminars around the globe.

EPISODE #015: Norman Hallett - http://thedisiplinedtrader.com - Norman Hallett is the co-founder and CEO of Subconscious Training Corporation (STC), headquartered in Parkland, Florida. STC develops state-of-the-art mental training software for a wide variety of areas, ranging from business to sports to business skills to trading. The company’s core concentration is the training of Traders. After having spent time with Paine Webber as a stock broker, Mr. Hallett has developed numerous successful startup companies, including the CTA investment firm of Hallett Commodities, Inc., and the Introducing Broker operation, NCH Commodities, Inc. Mr. Hallett holds a BA in Mathematics from the University of Cincinnati. His high-profile style resulted in him being a frequent guest of the Financial News Network and culminated in his popular radio talk show, "Risky Business", which had a strong 5-year run. His concise ebook, “Mental Fitness for Traders”, went viral and has been downloaded by over 100,000 traders worldwide. The Disciplined Trader Trading and Support Program has tightened up the trading discipline of thousands of traders from 16 different countries.

EPISODE #014: Joe Krutsinger - Joe Krutsinger began his futures and options career over forty years ago with Conti Commodity. He has worked in almost every facet of the trading industry and continues to be a prolific developer of trading systems. He has developed proprietary trading programs for numerous clients and brokerage firms. Joe now works directly with clients and brokerage firms designing custom trading systems. He has been a trading system design consultant since 1989 and consults with traders on how to develop systems using state of the art system automation software. Joe was recognized as the Outstanding Senior in Food Systems, Economics, and Management from Michigan State University in 1973. A featured speaker and teacher at seminars and meetings worldwide, he co-authored THE COMMODITY COOKBOOK:RECIPES TRADING, LESSONS FROM THE MASTERS. (This was the 1990 book of the year, the 1990 Supertrader’s Almanac-Calendar Edition). Joe has also been featured in the Future’s Learning center three video course, TRADING SYSTEMS 101,102, and 103.

EPISODE #013: Wally Olopade www.rightsidetrading.com - Wally Olopade is an award-winning speaker, fin-tech entrepreneur, and founder of Right Side Trading. He is a stock market expert who uses Quant data and technical analysis to identify sound companies at attractive prices with low risk and potential for capital appreciation. Wally believes the stock market is NOT random and has consistently timed many of the market tops and bottoms. Wally has been featured on Yahoo Finance, Benzinga, Traders Talk Live, and other media outlets.

EPISODE #012: Price Headley www.bigtrends.com - BigTrends.com is located in Lexington, KY and was founded on November 15th, 1999 by Price Headley, a Lexington native, graduate of Duke University and author of "Big Trends in Trading: Strategies to Master Major Market Moves." Price was inducted into the Traders' Hall of Fame in 2007 and appears regularly on CNBC, Fox News and Bloomberg Television, and in a variety of print and online financial news outlets, including The Wall Street Journal, Barron's, Forbes, Investor's Business Daily and USA Today. Price also speaks regularly to investment audiences nationwide.

EPISODE #011: David Kosmider TimingResearch - TimingResearch.com was created by David J. Kosmider and has been publishing the free Crowd Forecast Newsletter since September 2013. The concept for the Crowd Forecast Newsletter was partially inspired by the ideas described in the following books: >The Wisdom of CrowdsCrowdsourcing by Jeff Howe.

EPISODE #010: Jody Samuels www.fxtradersedge.com - Jody Samuels is one of North America’s leading coaches for traders, and a sought after speaker at the World Money Shows and NY and Las Vegas Traders Expos. After graduating from The Wharton Business School in Finance, Ms. Samuels joined US global investment bank JP Morgan on Wall Street for 15 years, trading currencies and managing professional traders, using the proven theories of Elliott Wave analysis which she teaches today to retail and institutional traders. She has been interviewed by Bloomberg Television, The Money Show, and FX Street for the Women in Forex article which also appeared in FX Trader Magazine. She has written articles for Stocks and Commodities Magazine (TASC) and her first book ‘The Traders Pendulum’ was published by Wiley in 2015. Jody has trained thousands of new and seasoned traders how to use Elliott Wave as an overlay to any strategy to spot high probability trade setups in order to make more profitable trades and waste less time. Jody Samuels is passionate about teaching individuals how to trade the market “waves” and use entrepreneurial skills and habits to effectively manage their business.

The strategies she teaches in her courses and her live daily approach to trading provide you with the understanding and the tools to take your trading to the next level. She personally manages her own accounts and shares her market knowledge and trades LIVE everyday with her clients worldwide. She is a contributor to many financial media outlets and a well respected technical analyst known for her precision in determining market conditions and pinpointing market direction with the highest accuracy.

EPISODE #009: Harry Boxer www.thetechtrader.com - What sets The Tech Trader apart from other online trading communities, starts with the leadership of Harry Boxer, a 50-year veteran of stock market technical analysis. Harry begins every day in the pre-market, analyzing premarket percent gainers and losers, creating a relevant focus list and webinar presentation to determine which stocks may be best for potential day trades, issuing buy and short alerts, during his presentation. During the regular session, Harry is on a live webinar, with hundreds of his members, monitoring those stocks, ETF’s and Indexes throughout the day, updating support, resistance, targets, and stops, creating an informational and educational experience for his clients. In addition, Harry is on after the close, monitoring after-hours percent gainers.

EPISODE #008: Peter Eliades YouTube Channel | www.stockmarketcycles.com | peter@eliades.net - President Stockmarket Cycles Management Inc. Several times in the fall of 1974, in a market that had seen the average share of stock drop for almost 6 years since December 1968, he predicted on KWHY that a major market bottom would occur during the week of December 9-13, 1974. The exact Dow low of 570.01 occurred on December 9, 1974. As a result of that spectacular and well noted forecast, publication of Stockmarket Cycles began in July of 1975. In 1982, he began a long string of appearances on FNN, the nation's first financial network. He made several notable forecasts on FNN, and his forecast for a very important market bottom on January 24, 1983, was widely noted for several weeks prior to that date.

EPISODE #007: Michael Filighera www.tradershelpingtraders.com YouTube Channel - Michael’s history with the financial markets dates back to 1979 on the Pacific Stock Exchange Options trading floor. He has traded in the U.S., U.K. (London Traded Options Market), Netherlands (Amsterdam’s European Options Exchange), and Germany (DTB). He is an internationally published analyst of technical analysis (SeekingAlpha.com, European Traders Daily, Global Market Strategist and GMS Techstreet.com), covering the major indices, bonds, currencies, and commodities of Europe and the U.S. Currently, Michael is based in San Francisco and continues to analyze, trade, and research the markets. The eye of a storm is at the center where there is calm. In the midst of the many economic storms currently swirling around the globe, making decisions is often swayed by crowd behavior or panic as prices race in both directions. Opportunities present themselves during chaotic, panic driven times. Opportunities often missed due to all the “noise”. As a Market Maker on the San Francisco, Amsterdam, and London options trading floors, Michael studied the psychology both employed and self-employed by the most successful traders. Most if not all successful traders have the ability to stand within the chaos and pull out opportunities without succumbing to the panic itself.

EPISODE #006: Adrienne Toghraie Traders Coach and Master Linguistic Programmer www.tradingontarget.com Adrienne: adtoghraie@gmail.com - Specialties: Coaches Individuals, groups and teams on issues of overcoming self-sabotage, conflict resolution, building teamwork to create peak performance.

EPISODE #005: Jim Kenney the Option Professor www.optionprofessor.com - The Option Professor is a graduate Boston College, Trained at The Options Institute-35+yrs.

EPISODE #004: Glenn Neely on NEoWave Theory www.neowave.com Glenn: cs@neowave.com - Internationally regarded money manager, trading advisor, and Elliott Wave analyst, Glenn Neely has devoted over 40 years to advancing trading strategies and Wave forecasting - always with the goal of achieving real-world results. Glenn Neely's Neely River trading technology assists in creating lower-risk trading strategies, with an emphasis on capital preservation. His now-famous NEoWave forecasting methodology provides a precise, step-by-step, logical assessment of market structure, which typically leads to more accurate forecasts.

EPISODE #003: Perry J. Kaufman Pontificates www.kaufmansignals.com Perry: kaufmansignals@gmail.com - Beginning as a “rocket scientist” in the aerospace industry, Kaufman worked on the navigation and control systems for the Orbiting Astronomical Observatory, the predecessor of the Hubble Space Telescope. Moreover, he was involved in the development of navigation systems for Project Gemini which were later used for Apollo missions. Kaufman worked in trading, research and advisory functions at major commercial banks, securities houses, central banks, and hedge funds. After leaving the aerospace industry, Kaufman became a partner in an Illinois-based farm management company where, as a commercial hedger, he developed expertise in trading commodity futures markets. Between 1981 and 1991, Kaufman resided in Bermuda where he worked as Head of Trading Systems for Transworld Oil, Ltd. (Bermuda). He was a principal at Man-Drapeau Research (Singapore) from 1992 to 1998 and worked in consulting functions for Cinergy and Prudential-Bache. Between 2003 and 2008, Perry J. Kaufman worked as a portfolio manager and senior quantitative analyst for Graham Capital Management, a hedge fund with a focus on managed futures trading strategies. Kaufman is currently a consultant to Mizuho Alternative Investments and serves as a board member at ARIAD Asset Management GmbH. Kaufman also advises the Aquantum Group and collaborates with the company in the design of systematic trading programs and indices.

EPISODE #002: A Visit with Technical Trading Rock Star Tim Slater Tim: tcslaternola@me.com - The CompuTrac program began its early development in 1977 when Slater realized that the Apple II computer, could read large amounts of data, calculate the technical indicators and display graphics on its 10-inch monochrome green screen. However, with no programming experience, Slater was led to the computer science department at Loyola University of New Orleans and met Professor James Schmit. With Tim’s understanding of the commodity markets and Jim’s knowledge of the BASIC programming language for the personal Computer, they planned, programmed, and completed the first commercial CompuTrac version 1.0 in July 1977. The first office was set up in Slater’s home in the Garden District, New Orleans. Schmit transitioned from university teaching and began to manage a small part-time team of programmers drawn mostly from among his students. Slater handled marketing, sales, and contributed to product strategy by consulting with a growing pool of other traders and technical analysts who took a keen interest in the CompuTrac software by contributing to its library of technical analysis studies and tools. To help finance the very early development of Compu Trac, Slater approached three fellow market technicians who were following his early progress in commercializing the first version. Walter Bressert, Jim Sibbett, Richard L. Redmont along with Tim Slater, its founder, were the original "members" of the TAG group. The company was incorporated as the "Technical Analysis Group" or TAG for short. Shares were issued to Slater, Schmit and the group's early investors. Many of the technical indicators and studies used today were first implemented and popularized in CompuTrac. The Stochastic oscillator study, for example was programmed from the work of George Lane and Ralph Dystant. The indicator's lines were named "%K" and %D" but Slater needed a single name which was more accessible and the word "stochastic" was written on the paper, so he gave the study that name, and it has persisted. Another example is the Moving Average Convergence/Divergence (MACD) study by Gerald Appel.

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don't spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.

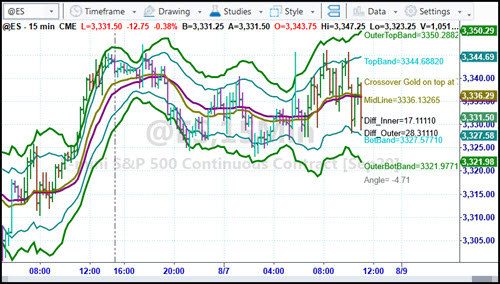

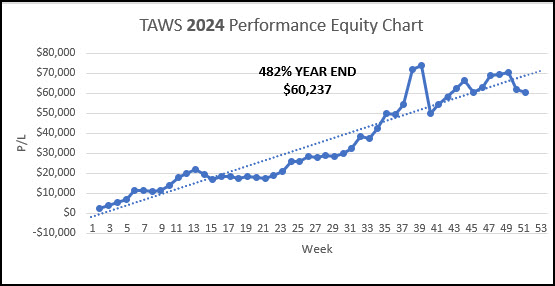

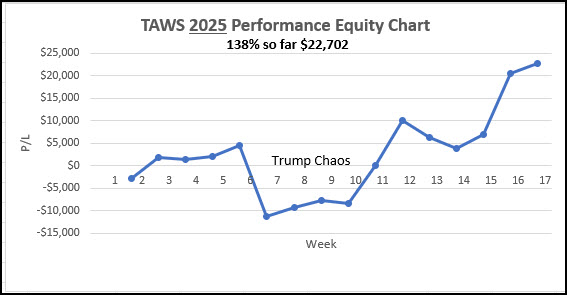

NOW AVAILABLE: Live Trading with Sunny EVERY MORNING. (Trade Along with Sunny - TAWS) Want to see and hear how Sunny trades with SunnyBands? Listen to her reasoning and watch as she places trades. Here's your chance. Subscribe Here.

PERFORMANCE 2024 Year-End:

PERFORMANCE 2025 To Date

"Hi Sunny, wanted to share with you my profits for the day and say thank you! $19,412.50." -S. S., Mission Viejo, CA

"I wanted to let you know how helpful your daily trading room sessions have been. It is refreshing to see someone trade live and answer any questions that we have. It is so much better than a service that just wants to sell you something and send you on your way. This is really speeding up my learning and I look forward to trading along with you. Thanks for all you are doing to help people learn the art of trading." - Rick N.

"I had the fortune of meeting Sunny Harris and her excellent trade software SunnyBands. From the beginning, she gave me all her support, even though I didn't have any experience with day trade and English is not my first language she is always available for any questions. I tested SunnyBands free trial and the results were amazing $3.5K in the first week, I asked for another free trial and she was able to help me, I did it again, and after these records, I decided to buy the license for Sunny Bands. Thank Sunny for your unconditional support and your excellent software." -Juan R.

"I have studied swing and day trading for 10 years primarily with Gann methodology but I might be able to say I have studied it all. I lead a monk's life studying 12 hrs a day. I have found SunnyBands correlate to the high work of mathematics in price and one tool I treasure now for my chart analysis and trading. The first day I loaded SunnyBands I made $275 with one contract in about a minute; I thought to myself how can this small monthly fee not pay for itself? The opportunity to trade with such an experienced trader as Sunny is a real gift; the experience you will get in a year will be priceless. Doing this each trading day with Sunny will train your subconscious mind to become a consistent winner in the market. If you are thinking with a poverty mindset you will have a long hard road; don't do that. This is really awesome to be able to trade with each day and so appreciative of you doing this. To live trade as a mentor like you do is very hard and much respect and appreciation for you doing this Sunny!" - Arthur M.

"Well, I just want to say the I LOVE them !!!! ( your bands )....I've torn apart Bollinger Bands, Keltner etc, etc... and NOTHING comes CLOSE to what YOU have created.... :-) I've talked to CMT's who've said "oh yeah.... they're just Bollies".....and I almost spit out my coffee! I've watched your videos where you are walking a new customer through their use... and I "got it all" ( understood )... the "turns" are RIGHT THERE!.... Bollies are too general....and Keltner which Rashke says she likes....are only a hair better than Bollies.... YOURS blows both of them away.....of course YOU already know that." - Marius V.

The Podcasts of John Bolllinger, Steve Nison, Gene Inger, Hima Reddy, Brad Matheny, William Eng, Louis Navellier, Cynthia Kase, Howard Getson, Jake Bernstein, Arch Crawford, Henry Weingarten, Robert Pardo, Sherman & Tom McClellan, Stan Ehrlich, Steven Primo, Carolyn Boroden, Markus Heitkoetter, Dan Passarelli, Ted Hearne, Larry Pesavento, Norm Winski, Greg Morris, Larry Williams, Linda Bradford Raschke, Anka Metcalf and Robert Colby are now posted. Enjoy these great interviews. And after that whom would you like to see next?

You've had plenty of opportunites to watch how Sunny trades. There's the Live Trading Room, lots of Appearances, YouTube videos and Live Demos. If you have not yet been introduced to SunnyBands and how Sunny uses them, sign up here to get the Replay of the event.

WHAT ARE YOU MISSING?

Several features of Sunny Side of the Street are missing from previous issues. Natural Numbers, Scan of Stocks, DMA_H RS, PHW Scan, and more. What would you like to see me bring back? Comments.

HAPPY HALF HOUR! We will have the next HHH on Saturday January 4th at 1:15pm PT.Sam Tennis and I will be hosting the Next Free Networking Event for all Traders new and old to join in the discussion and "get to know each other" event. It's a great place to make new friends. Sign Up Here. This Free meeting of like minds will be held once a month, on the 4th of each month. We all have a great time and share liberally on the 4th of evey month. It's a lot of fun! Don't miss it next time. Click HERE to join us. You must be registered to get the invitation and link.

Free Live Demo Replay available Here.

If you would like to continue receiving this weekly newsletter every week, please SUBSCRIBE. It helps the cause.

FREE 7-Day Trial of Sunny's Most Powerful Indicators. Click Here. You have 7 (calendar) days to use it' full functionality and learn! I can only take 20 trials per month and all start on a Monday. Get your request in early.

EasyLanguage Forum Want to learn EasyLanguage (EZL) the EASY way? Here is the REPLAY (with video and slides). 5 1-hr lessons will take you through all the steps with Sunny Harris and Sam Tennis.

FREE 7-day Trial of Sunny's most Powerful trading indicators. Not sure about buying them? Take the trial. Most make enough during the Free Trial to cover the investment.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

Go to www.easylanguageooel.com, register as a Free Member and I'll send your FREE indicators wi th your proof of purchase